County Tax Map – This map shows road improvement projects from 2025 through Weleski explained that Hubbard County may renew its local transit tax option every two years. “It’s half a cent on retail sales,” she . What Is Property Tax? Property tax is a levy imposed on real estate by local governments, primarily used to fund public services such as schools, roads, and emergency services. Mo .

County Tax Map

Source : taxfoundation.org

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Source : tpwd.texas.gov

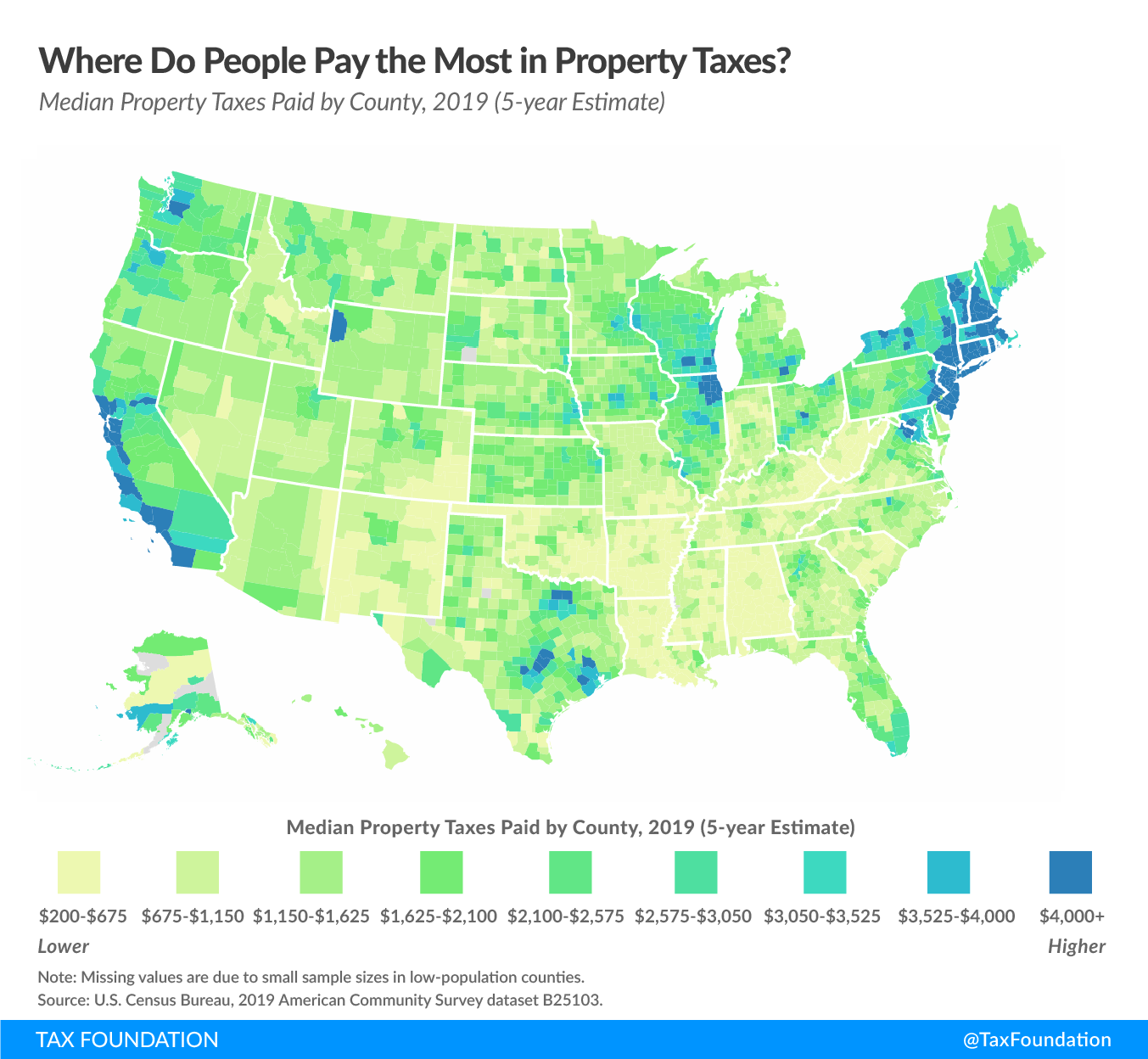

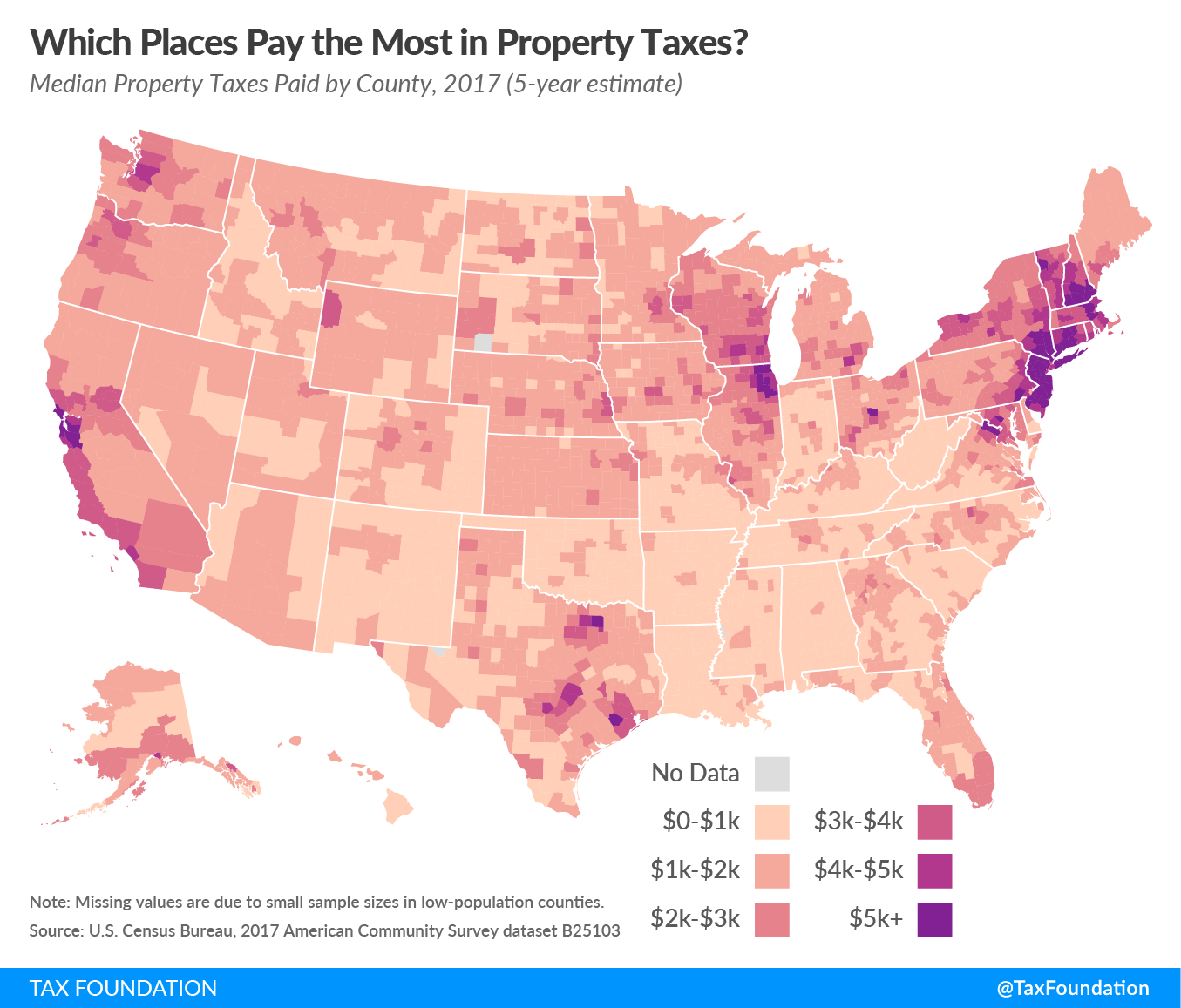

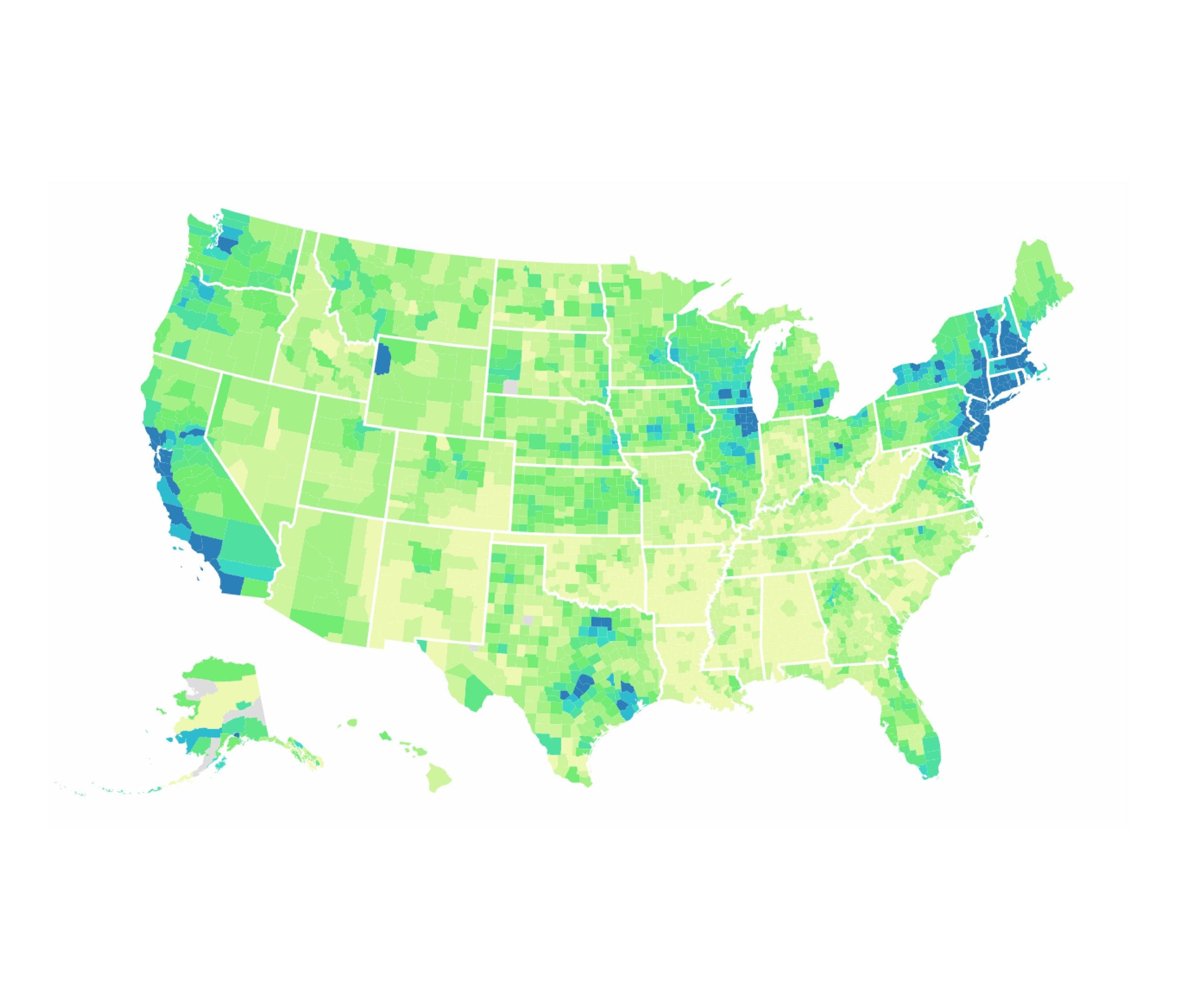

Property Taxes by County | Interactive Map | Tax Foundation

Source : taxfoundation.org

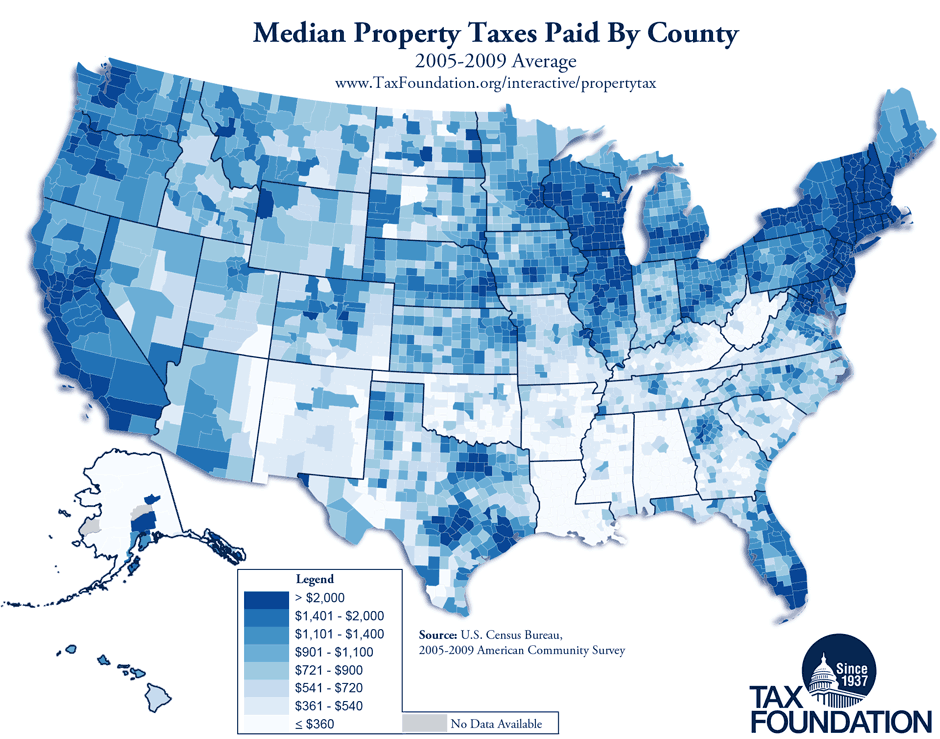

Monday Map: Property Taxes By County, 2005 2009 Average

Source : taxfoundation.org

Property Taxes by County | Interactive Map | Tax Foundation

Source : taxfoundation.org

Real Property Tax Services Portal

Source : www.co.essex.ny.us

Property Taxes by County | Interactive Map | Tax Foundation

Source : taxfoundation.org

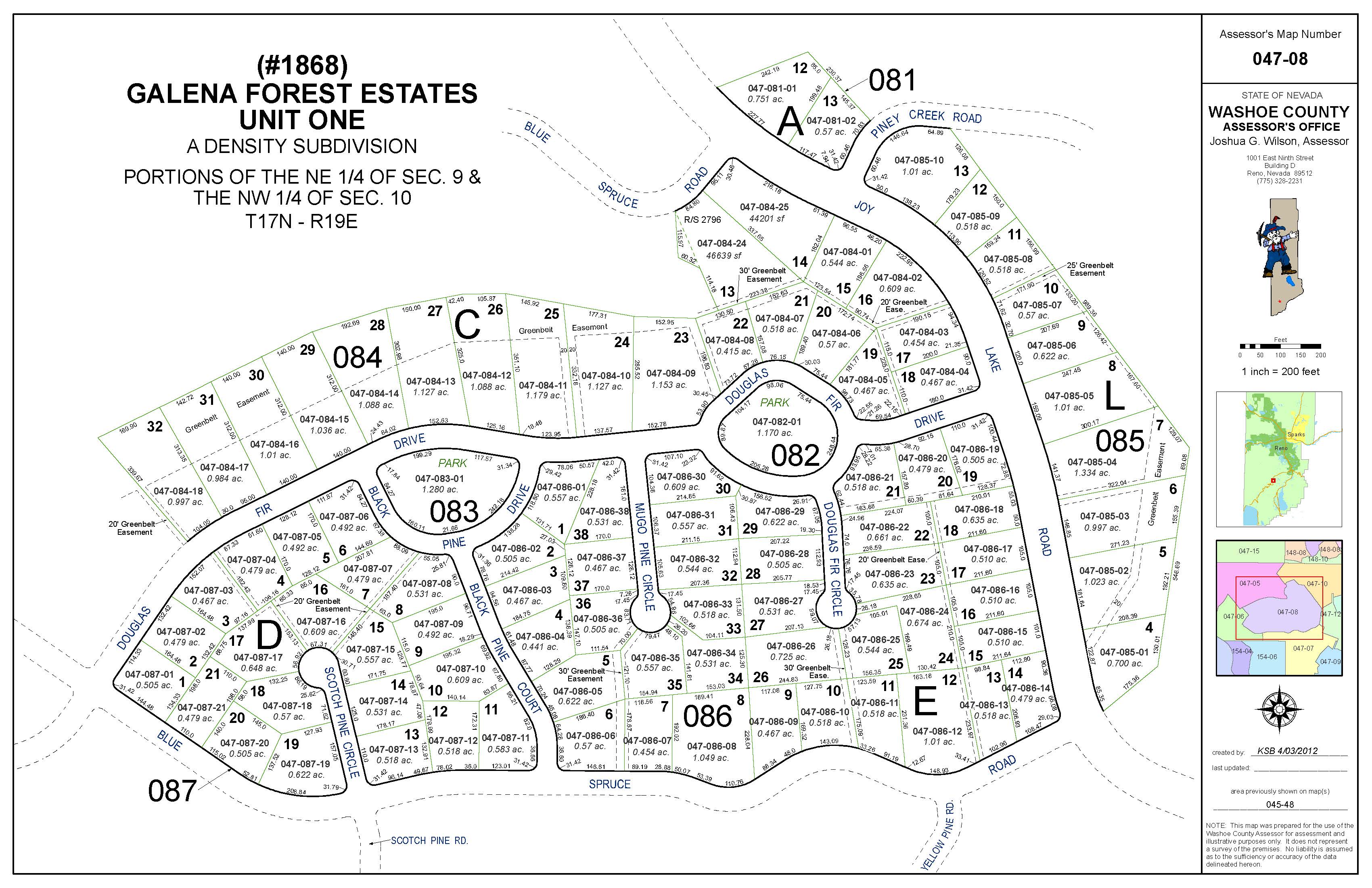

Mapping

Source : www.washoecounty.gov

Tax Map Grid | Fairfax County GIS & Mapping Services Open Data Site

Source : data-fairfaxcountygis.opendata.arcgis.com

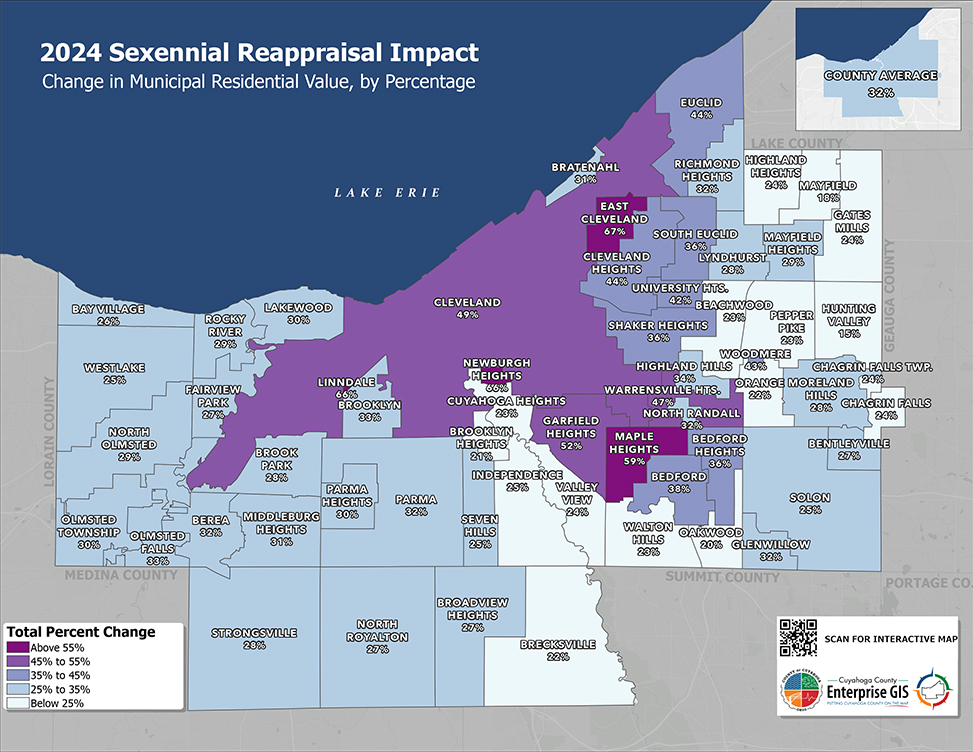

2024 Sexennial Reappraisal

Source : cuyahogacounty.gov

County Tax Map Property Taxes by County | Interactive Map | Tax Foundation: The report confirms what’s been reported many times before: New Jersey has the nation’s highest property taxes. But it also reveals a surprising (and unfortunate) statistic: seven of the 15 counties . County Highway Engineer Andrea Weleski provided details about both matters at the Tuesday, Aug. 20 Hubbard County Board meeting. .